what is sales tax in tampa

The minimum combined 2022 sales tax rate for Tampa Florida is. There are a total.

Florida S Back To School Sales Tax Holiday Begins July 25 Wfla

Lemon Street Municipal Office Building.

. 4900 W Lemon Street. The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue.

Select the Florida city from the list of popular cities. Average Sales Tax With Local. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Hillsborough County Florida is. There is no applicable city. You would pay 23500 for the.

The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. What salary does a Sales Tax earn in Tampa. 551 Sales Tax Salaries in Tampa provided anonymously by employees.

Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211. The 6 state sales tax applies to the full purchase price and the 1. What is the sales tax rate in Tampa Florida.

Tampa collects the maximum legal local sales tax. Counties and cities can. Business Tax Supervisor.

What is the sales tax in Pinellas County FL. Floridas general state sales tax rate is 6 with the following exceptions. This is the total of state county and city sales tax rates.

The Hillsborough county and Tampa sales tax rate is 75. The full price was 30000 but you received a trade-in value of 5000 a manufacturers rebate of 500 and a dealer incentive of 1000. Florida imposes a variety of taxes including state income tax corporate income tax sales tax and local sales tax.

This includes the rates on the state county city and special levels. Tampa is located within Hillsborough County. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Groceries and prescription drugs are exempt from the Florida sales tax. The average cumulative sales tax rate in Tampa Florida is 75.

Florida has recent rate changes Thu Jul 01 2021. With local taxes the total sales tax rate is between 6000 and 7500. In terms of tax rates Florida has a fairly good tax code.

Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. The December 2020 total local sales tax rate was 8500. What is the sales tax rate in Hillsborough County.

Sales Tax By State Is Saas Taxable Taxjar

What Is The Hillsborough County Sales Tax The Base Rate In Florida Is 6

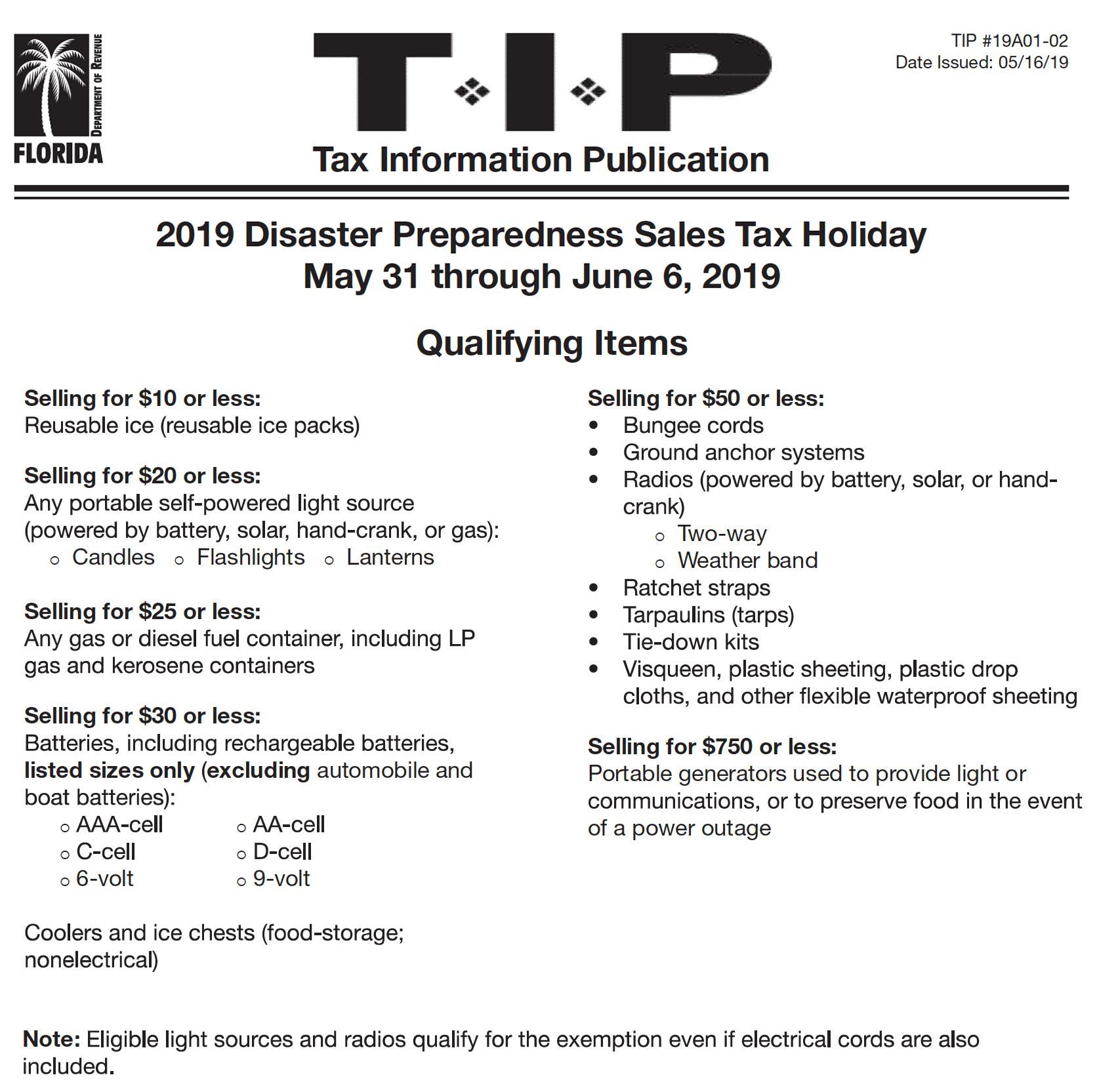

City Of Tampa Hurricaneseason Is Here And So Is The Disaster Preparedness Sales Tax Holiday Now June 6th Get Items For Your Emergency Supply Kit Tax Free Including Flashlights

Who Controls Florida School Sales Tax Referendums

Florida Disaster Preparedness Sales Tax Holiday Starts May 28 What To Know Youtube

Tampa Solar Installers Sem Power Call Today

Sales Tax Holidays Politically Expedient But Poor Tax Policy 2017

Hurricane Preparedness Supplies Are Tax Exempt May 31 June 6th Tampa Hillsborough Expressway Authority

Morning Briefing Tampa Aug 2 2022

Florida Sales Tax Small Business Guide Truic

Amendments To The Us Sales Tax According To The Wayfair Decision Ebner Stolz

Florida S Sales Tax Holiday For Tools Starts Saturday Wtsp Com

Florida Sales Tax Rates By City County 2022

Sales Tax No Tax For Tracks Florida

Tampa Cost Of Living 2022 Can You Afford Tampa Fl Data

We Have Expanded To Serve Tampa Fl J David Tax Law

Plans Move Forward On Where Transportation Sales Tax Will Go

One Percent Tax Increase To Be On The Hillsborough County Ballot Wtsp Com